Charles Schwab, founded in 1971, is a prominent name in the investment world. They’re a leading provider of brokerage and financial advisory services, empowering individuals to invest and manage their wealth. Here’s a quick snapshot:

- Founded in 1971 by Charles R. Schwab

- Headquartered in San Francisco, California, USA

- Millions of client accounts under management

- Offers a comprehensive suite of investment products and services

What are the selection and Interview process of Charles Schwab?

The selection process at Charles Schwab can vary depending on the specific role (financial advisor, investment consultant, branch manager, technology analyst, etc.), department (wealth management, investment services, technology, etc.), and experience level required. Here’s a roadmap to navigate the potential steps involved:

1. Application: Submit your application through Charles Schwab’s careers website.

2. Application Review: Recruiters and hiring managers meticulously screen resumes and applications to shortlist candidates whose qualifications align with the position and Charles Schwab’s focus on client service, financial knowledge (for relevant roles), and a commitment to ethical conduct.

3. Assessments (Possible): Some positions might involve online assessments:

- Financial Knowledge Assessments: These could assess your understanding of financial products, investment principles, and risk management (especially for client-facing roles).

- Technical Skills Assessments (Possible): These might assess your knowledge of specific software programs or technology relevant to the role (e.g., for IT-related positions).

4. Interviews: If your application and assessments (if applicable) impress them, prepare for one or more rounds of interviews:

- Phone Interview (Possible): An initial phone interview with a recruiter or hiring manager to discuss your background, interest in the role, and general understanding of the financial services industry (especially for non-financial roles).

- In-Person Interviews: If you progress further, you might have interviews with a panel that could include:

- Hiring Managers and Team Members from the relevant department

- Experienced Professionals in the field (e.g., senior financial advisors, investment consultants)

- HR Representatives

These interviews will delve deeper into your experience, knowledge, and skills relevant to the specific position. Here are some areas they might explore:

* **Understanding of the financial services industry and current market trends.** (especially for client-facing roles)

* **Strong client service orientation and ability to build trust with clients.** (highly valued across various roles)

* **Financial expertise relevant to the role (e.g., knowledge of investment products for financial advisors).** (for relevant roles)

* **Communication and interpersonal skills.**

* **Problem-solving and analytical skills.** (especially for some roles)

* **Teamwork and collaboration skills.**

- Second Interview (Possible): For some roles, especially senior positions or those in wealth management, there might be a second round of interviews with senior management or regional leaders.

5. Background Check: Upon receiving an offer, a background check is standard procedure.

Timeline: The interview process at Charles Schwab can take anywhere from a few weeks to several months, depending on the complexity of the role, the number of candidates involved, and required clearances (especially for financial advisor roles).

Here are some additional tips for making a positive impression during your Charles Schwab interview:

- Research the company: Learn about Charles Schwab’s commitment to client education, their focus on using technology to empower investors, and company culture, which emphasizes collaboration, a client-centric approach, and continuous learning.

- Tailor your resume and cover letter: Highlight the skills and experiences that are most relevant to the specific position you are applying for. Showcase your customer service skills, financial knowledge (if applicable), and your interest in the financial services industry.

- Prepare for common interview questions: Research common interview questions in the financial services industry or your specific field, and be ready to showcase your skills and knowledge. Be ready to discuss your approach to providing exceptional client service, your understanding of relevant financial concepts (if applicable), and how you would contribute to Charles Schwab’s mission of helping clients achieve their financial goals.

- Practice behavioral questions: Be prepared to answer questions about your past experiences using the STAR method (Situation, Task, Action, Result) and how they demonstrate your problem-solving, teamwork, and communication skills, with a focus on client service or financial expertise (depending on the role).

- Dress professionally and present yourself with a confident and professional demeanor.

By being well-prepared, demonstrating your qualifications, and showcasing your passion for helping people invest wisely, you can increase your chances of landing your dream job at Charles Schwab.

How many rounds of interview conducted in Charles Schwab?

There isn’t publicly available information on the exact number of interview rounds or salary information for freshers at Hartford Financial Services Group. Their careers website doesn’t provide this detail. Here’s what you can do to get a better idea:

Number of Interview Rounds:

Based on information gathered from general job search trends and employee reviews on websites like Glassdoor and Indeed, you can expect:

- Possible Range: Two to four rounds after an initial application.

Interview Stages (Possible):

- Initial Application: Submit your resume and cover letter online. You might also encounter a web-based assessment about your skills or suitability for the role.

- Phone Interview (possible): A recruiter might conduct a brief phone interview to discuss your experience and interest in Hartford Financial Services Group.

- In-Person Interviews (one to three rounds): These could involve discussions with:

- Hiring Manager or Team Members: They will assess your qualifications, experience, and fit for the specific role (e.g., financial analyst skills for finance positions).

- Specialists (possible for some roles): For specialized positions (e.g., underwriting, data analysis), you might meet with specialists to assess your technical skills or knowledge relevant to the role.

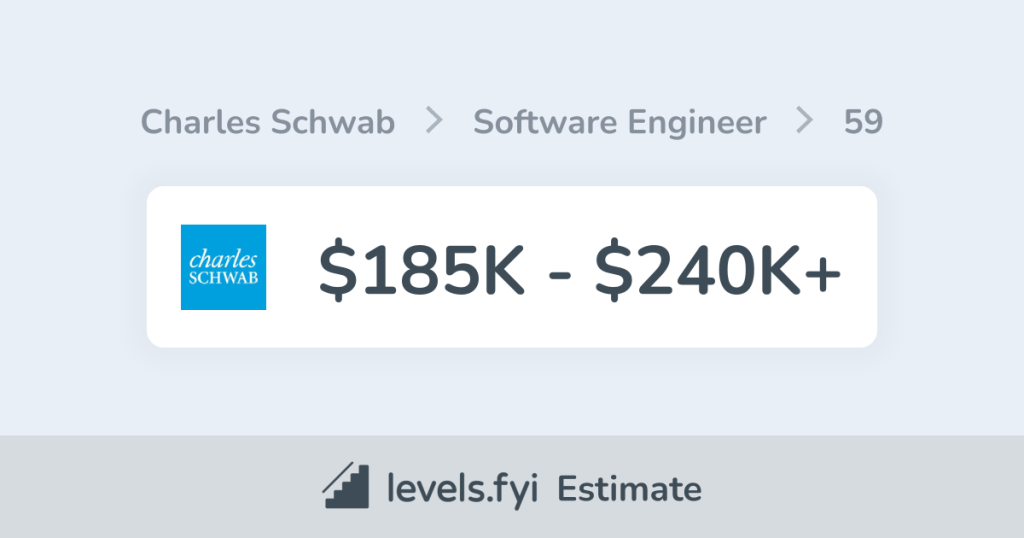

What is the salary for freshers in Charles Schwab?

Salary Websites: Explore salary websites like Glassdoor or Indeed. Search for “Hartford Financial Services Group” and filter by “entry-level” or “freshers” positions in your target location to get a sense of the range for similar roles (e.g., financial analyst, underwriter).

Levels.fyi: This website allows anonymous employees to share salary information. While not an official source, it can provide insights into salary ranges at Hartford Financial Services Group based on user-submitted data. Search for “Hartford Financial Services Group” and filter by “entry-level” or “freshers” positions.

Networking: If you know someone who works at Hartford Financial Services Group, try reaching out to them for insights into starting salaries for freshers in your field (e.g., finance, data analysis).

Tips:

- Research Hartford Financial Services Group: Learn about the company’s areas of focus in the financial services industry, their products and services, and their company culture. This demonstrates your genuine interest during the interview.

- Highlight Relevant Skills and Experience: Tailor your resume and interview responses to showcase skills and experiences relevant to the specific role you’re applying for. This could include technical skills (for finance or data analysis positions), coursework (relevant to your field of study), and a willingness to learn.

- Prepare for Behavioral and Technical Questions (if applicable): Be prepared to answer questions using the STAR method (Situation, Task, Action, Result) to showcase your problem-solving skills and past achievements. For technical roles, be ready for questions related to relevant financial concepts or data analysis techniques.

By following these steps, you’ll gain a better understanding of the interview process and potential salary range for freshers at Hartford Financial Services Group. Remember, your specific skills, experience, and qualifications can also influence your starting salary.

Top questions Asked for freshers in Charles Schwab

Charles Schwab, a leading financial services company, offers exciting opportunities for recent graduates (freshers) in various departments. Here are some general questions you might encounter during an interview, along with some specific examples depending on the role:

General Skills and Financial Industry Knowledge (Basic Understanding is Okay):

- Tell me about yourself and your interest in Charles Schwab. (Highlight relevant skills like communication, teamwork, problem-solving, analytical thinking (if applicable to the role), and an interest in finance, business, or financial technology (if applicable). Mention what interests you about Charles Schwab’s focus on investor education, their commitment to technology innovation, or a specific area like wealth management (if applicable)).

- Describe a situation where you demonstrated excellent customer service skills (if applicable to the role). (Focus on how you resolved a customer’s issue or went the extra mile to provide a positive experience).

- Explain a time you had to work effectively in a team on a project. (Showcase your teamwork abilities and communication skills).

- What are your strengths and weaknesses? (Be honest but highlight strengths relevant to the financial services industry or your desired role, like attention to detail, accuracy, a willingness to learn quickly, and a strong work ethic).

- Why do you want to work at Charles Schwab? (Express your interest in learning about the financial services industry, a desire to gain experience in a fast-paced and client-focused environment, or an interest in Charles Schwab’s use of financial technology. You can also mention their company culture or their focus on financial literacy).

- Do you have any questions for us? (Always have thoughtful questions prepared about the role, company culture, or mentorship programs for freshers at Charles Schwab).

Additional Questions (May Vary by Role):

- (For Client Service Roles): How would you approach explaining a financial product or service to a potential client?

- (For Financial Analyst Roles): Describe a situation where you analyzed data to solve a problem (if applicable to your coursework).

- (For Technology Roles): How would you stay up-to-date on the latest trends in financial technology (FinTech)?

Tips:

- Show your enthusiasm and willingness to learn, even if your financial services knowledge is basic. Charles Schwab emphasizes providing excellent customer service, staying informed about industry trends, and embracing innovation.

- Highlight your ability to work independently and as part of a team in a dynamic environment.

- Demonstrate a problem-solving mindset and an interest in learning about finance (if applicable).

How to apply for job in Charles Schwab?

Here’s a guide on applying for a job at Charles Schwab:

- Visit the Charles Schwab Careers Website: Head over to Charles Schwab Careers page.

- Search for Jobs: Utilize keywords related to your field or browse job categories (e.g., Client Services, Financial Analyst, Technology, Marketing, Finance). Look for “Entry Level” or “Associate” positions that align with your skills and interests. Consider which areas of Charles Schwab’s work (e.g., investment services, wealth management, financial planning, financial technology) you might be interested in.

- Find the Perfect Fit: Carefully read job descriptions and identify roles that align with your qualifications and aspirations within the financial services industry. Consider your strengths and what kind of work environment you prefer (direct client interaction, financial analysis, financial technology development, or marketing).

- Apply Online: Submit your application electronically for the chosen position. Tailor your resume and cover letter to the specific role, highlighting relevant coursework, any prior experience (if applicable), and your eagerness to learn and contribute to Charles Schwab’s mission of helping people achieve their financial goals.

- Prepare for Interview: If shortlisted, research Charles Schwab further, including their commitment to financial literacy, their use of innovative technology platforms, and their focus on client service. Practice answering common interview questions and prepare thoughtful questions for the interviewer about the role, company culture, and development programs for freshers at Charles Schwab. Demonstrate your professionalism, strong work ethic, and potential to excel in a dynamic and client-focused financial services environment.

By showcasing your relevant skills, interest in finance (if applicable), and willingness to learn, you can increase your chances of landing a job at Charles Schwab.

Say goodbye to the hassles of bike ownership! MotoShare.in offers affordable rentals, whether you need a scooter for errands, a bike for a road trip, or a reliable ride to explore new cities.

Starting: 1st of Every Month

Starting: 1st of Every Month  +91 8409492687

+91 8409492687  Contact@DevOpsSchool.com

Contact@DevOpsSchool.com