Massachusetts Mutual Life Insurance Company, often shortened to MassMutual, is a leading provider of financial products and services with a rich history. Here’s a quick snapshot:

- Mutual Ownership: Unlike some insurance companies with shareholders, MassMutual is a mutual company. This means policyowners share ownership and potentially benefit from the company’s success.

- Financial Strength: MassMutual boasts a strong financial record, offering stability and security to its policyowners.

- Holistic Approach: They go beyond just life insurance, offering a wide range of financial products like retirement planning, disability income insurance, and annuities.

Career Opportunities:

A career at MassMutual opens doors to diverse opportunities in the financial services industry:

- Financial Advisors: Providing personalized financial planning and guidance to clients, often focusing on life insurance and other MassMutual products.

- Sales and Marketing: Promoting MassMutual’s financial products and services to individuals and businesses.

- Underwriting: Assessing risk and determining eligibility for life insurance and other insurance products.

- Customer Service: Providing support and assistance to policyholders regarding their insurance coverage and financial needs.

- Financial Planning and Analysis: Analyzing financial data and supporting the company’s financial health.

What are the selection and Interview process of Massachusetts Mutual Life Insurance?

The selection process at MassMutual can vary depending on the specific role, department, and location. Here’s a general overview of the potential steps:

1. Application: Submit your resume and cover letter through MassMutual’s careers website [1]. Tailor your application materials to highlight relevant skills and experiences for the specific position you’re applying for.

2. Online Assessments (possible for some roles): You might encounter online assessments to gauge your abilities in areas like financial knowledge (especially for financial advisor roles), basic math skills, or situational judgment tests (depending on the role).

3. Phone Interview (possible for some roles): An initial conversation with a recruiter to discuss your qualifications and suitability for the role might occur.

4. In-Person Interview(s): This is a common stage and could involve one or two (or sometimes more) in-person interviews with hiring managers, financial advisors from the team (for advisor roles), or specialists relevant to the role (e.g., underwriters for underwriting roles). Be prepared for a mix of questions about:

* **Skills and Experience:** Showcase how your skills and experience align with the job requirements (e.g., financial planning knowledge for advisor roles, sales experience for sales positions, analytical skills for financial planning and analysis roles).

* **Financial Knowledge (especially for financial advisor roles):** In-depth questions related to life insurance products, financial planning concepts, and risk assessment might be asked.

* **Sales Aptitude (for some roles):** Your ability to build rapport with clients, understand their needs, and present financial products effectively might be assessed (especially for sales roles).

* **Client Service Focus:** Highlight your ability to provide excellent customer service and build strong relationships with clients.

* **Ethical Conduct:** Financial services require high ethical standards. Demonstrate your commitment to ethical financial practices.

5. Background Check and Drug Test: These are standard procedures for most positions at MassMutual.

Tips to Shine During the Process:

- Research MassMutual: Demonstrate your knowledge of their mutual ownership structure, focus on financial security, and the variety of products and services they offer.

- Highlight Your Skills and Achievements: Tailor your resume and interview responses to showcase your relevant skills and achievements, emphasizing financial knowledge (for financial advisor roles), sales experience (for sales positions), or prior success in your field.

- Client Focus: Express your passion for helping people achieve financial security and your ability to build strong client relationships.

- Communication Skills: Ensure clear and concise communication, both written and verbal, especially when discussing financial concepts.

- Ethical Demeanor: Showcase your integrity and commitment to ethical practices in the financial services industry.

By understanding the potential selection process, highlighting your relevant skills and experience (especially financial knowledge for financial advisor roles), demonstrating your client service focus, communication skills, and ethical demeanor, you can increase your chances of landing a rewarding career at MassMutual.

How many rounds of interview conducted in Massachusetts Mutual Life Insurance?

There’s no official one-size-fits-all answer to the number of interview rounds at Massachusetts Mutual Life Insurance (MassMutual). The interview process can vary depending on factors like:

- Specific Role and Department: Different departments or job functions might have varying interview needs. Senior or specialized roles might have more rounds than entry-level positions.

- Location: The interview process might differ slightly based on the physical location you’re applying to.

Here are ways to find out more about the interview process at MassMutual:

- Company Website: MassMutual’s careers website might have information about the typical interview process for different roles.

- Glassdoor: Search for “MassMutual interview experience” or “MassMutual [position name] interview” on Glassdoor to see if past candidates have mentioned the number of rounds in their interview experiences.

- Interview: If you progress past the initial application stage, the recruiter who contacts you might give you a general idea of the interview process.

What is the salary for freshers in Massachusetts Mutual Life Insurance?

Similar to the interview process, exact salary information for freshers at MassMutual can vary depending on the specific role, location, and your qualifications. Here are some ways to get a better idea of the salary range:

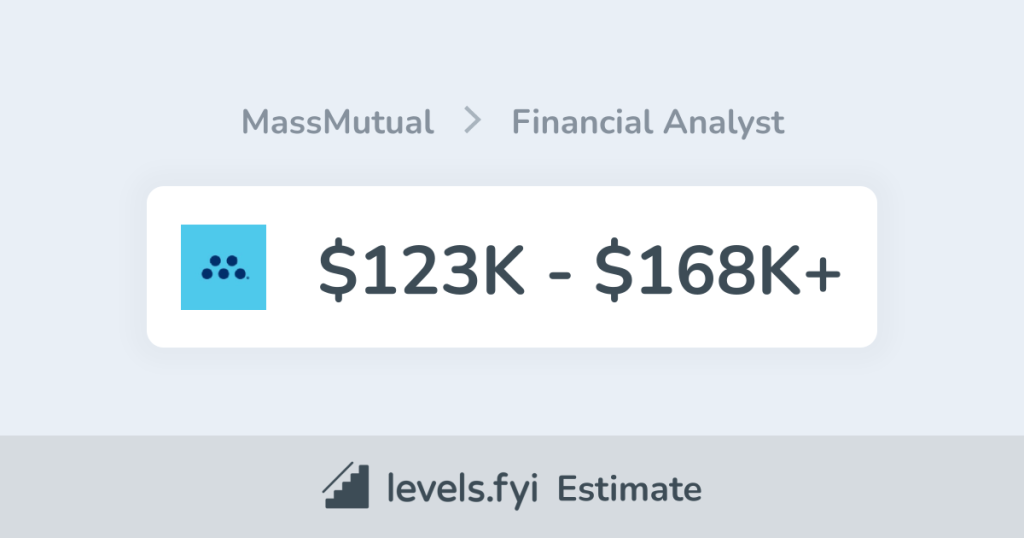

- Levels.fyi: This website allows you to search for salary information based on company, location, and job title. It can give you a general range for entry-level positions at MassMutual.

- Glassdoor: Glassdoor sometimes has salary information submitted by anonymous employees. Search for “MassMutual [position name] salary” to see if any data is available.

- Salary Comparison Websites: Websites like Indeed or Salary.com can provide salary information based on job title and location. Search for “Entry Level [Job Title] Salary in [Your Location]” to get a general sense of the range.

Tips:

- When applying for a job at MassMutual, tailor your resume and cover letter to the specific position. Highlight relevant skills and coursework, and showcase your interest in the insurance industry and MassMutual’s mission.

- Prepare for your interview by researching MassMutual and the specific role. Practice answering common interview questions and be prepared to ask thoughtful questions about the company culture and career development opportunities.

By following these tips, you can increase your chances of getting a job at MassMutual and potentially negotiating a competitive salary offer.

Top questions Asked for freshers in Massachusetts Mutual Life Insurance

Following are some of the top questions freshers typically ask about MassMutual:

- Company Culture and Career Development:

- What is the work environment like for recent graduates at MassMutual?

- Does MassMutual offer mentorship programs or other support systems for new hires?

- What are the career paths and opportunities for growth within the company for someone in (mention your specific field)?

- Role Specifics:

- What are the day-to-day responsibilities of someone in this position (mention the specific role you’re interested in)?

- What skills and experiences are most important for success in this role?

- Benefits and Compensation:

- Does MassMutual offer any tuition reimbursement programs for continuing education?

- What is the typical starting salary range for someone with my qualifications (mention your degree and experience)?

How to apply for job in Massachusetts Mutual Life Insurance?

There are a couple of ways to apply for a job at MassMutual:

- MassMutual Careers Website: MassMutual has a careers website where you can search for open positions and submit your application online. Look for “Careers” on the MassMutual website.

- LinkedIn: MassMutual also posts job openings on LinkedIn. You can follow MassMutual on LinkedIn and search for open positions that match your qualifications.

Some additional tips for applying for a job at MassMutual:

- Tailor your resume and cover letter to the specific position you are applying for. Highlight the skills and experiences that are most relevant to the job requirements.

- Research MassMutual and be prepared to talk about why you are interested in working for the company. What aspects of their mission or values resonate with you?

- Practice your interview skills and be prepared to answer common interview questions.

By following these tips, you can increase your chances of getting hired at MassMutual.

Say goodbye to the hassles of bike ownership! MotoShare.in offers affordable rentals, whether you need a scooter for errands, a bike for a road trip, or a reliable ride to explore new cities.

Starting: 1st of Every Month

Starting: 1st of Every Month  +91 8409492687

+91 8409492687  Contact@DevOpsSchool.com

Contact@DevOpsSchool.com