Northwestern Mutual is a leading financial security company in the United States. They primarily focus on offering life insurance, disability income insurance, and long-term care insurance. They operate through a unique model where financial representatives are both salespeople and policyholders, fostering a sense of shared ownership.

Here are some key facts about Northwestern Mutual:

- Founded in 1857

- Headquarters: Milwaukee, Wisconsin, USA

- Operates throughout the United States

- Mutual insurance company (policyholders are owners)

What are the selection and Interview process of Northwestern Mutual?

Northwestern Mutual’s selection process is known to be relatively rigorous, with a focus on finding individuals who are a good fit for their unique model. Here’s a general breakdown of what to expect:

1. Application: Submit your application through the Northwestern Mutual careers website. They often look for candidates with strong interpersonal skills and a desire to help others achieve financial security.

2. Online Assessments: You might be required to take online assessments to gauge your aptitude, personality traits, and basic financial knowledge.

3. Phone Interview: Shortlisted candidates will likely have a phone interview with a recruiter. This is an initial screening to discuss your background, interest in the role, and suitability for the company culture.

4. In-Person Interviews: If you progress past the phone screening, you can expect one or more in-person interviews. These interviews might involve: * District Manager or Agency Director: Discussing the role, expectations, and company culture in more detail. * Financial Representative Panel: Meeting with current representatives to learn about their experiences and ask questions. * Presentation: You might be asked to deliver a short presentation about yourself or a financial planning topic.

5. Background Check: Upon receiving an offer, a background check is standard procedure.

Timeline: The selection process at Northwestern Mutual can take anywhere from a few weeks to several months, depending on the complexity of the role and the number of candidates involved.

Tips:

- Research the company: Understand Northwestern Mutual’s business model, core values, and target market.

- Network with current representatives: Connect with people already working in the role to gain insights and assess if it’s a good fit for you.

- Prepare for behavioral questions: Be ready to answer questions that showcase your communication skills, problem-solving abilities, and passion for helping others.

- Be enthusiastic and demonstrate a strong work ethic: Financial representative roles often involve building a client base, so enthusiasm and a willingness to work hard are essential.

By understanding the process, researching the company, and preparing effectively, you can increase your chances of success in Northwestern Mutual’s selection process.

How many rounds of interview conducted in Northwestern Mutual?

The number of interview rounds at Northwestern Mutual can vary depending on the specific position and location, but here’s a general idea:

Number of Interview Rounds:

- Possible Range: Based on information on job boards and candidate experiences, expect 2-4 rounds for most positions [1, 2, 3].

Possible Interview Structure:

The interview process might involve a combination of the following stages:

- Phone Screening: A recruiter or HR representative might conduct a brief call to discuss your resume, interest in Northwestern Mutual, and suitability for the role.

- First In-Person Interview: This could involve meeting with a recruiter or a hiring manager to delve deeper into your experience and qualifications.

- Second In-Person Interview (Optional): Shortlisted candidates might be invited for a second round interview with a team panel or senior management depending on the role.

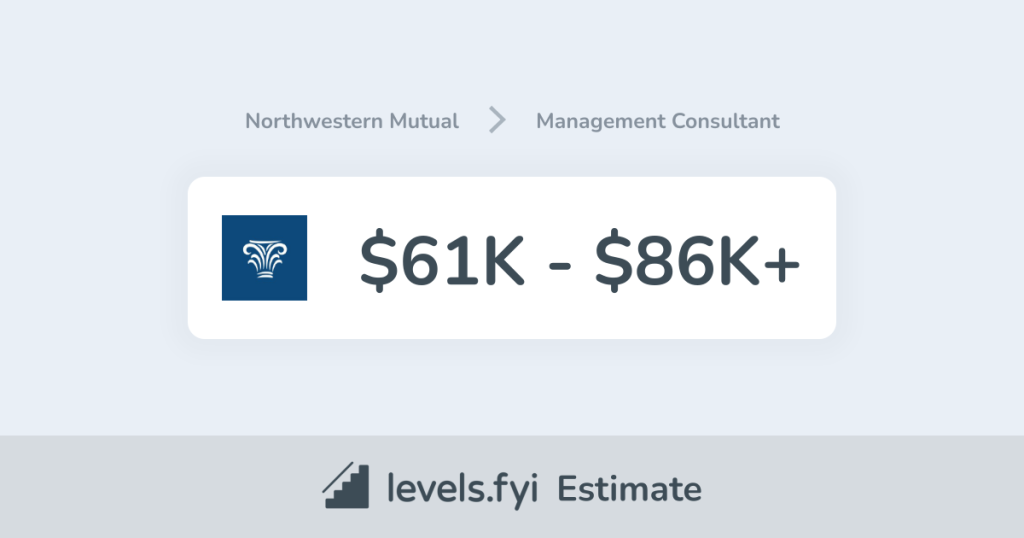

What is the salary for freshers in Northwestern Mutual?

While Northwestern Mutual doesn’t publish specific salary information for freshers, here are some resources that can help you estimate the range:

- Job Search Websites: Search for similar positions (e.g., financial advisor, financial representative) at Northwestern Mutual on Indeed or Glassdoor. You might find salary ranges or reviews with salary information from past applicants:

- Indeed

- Glassdoor

- Salary Comparison Websites: Explore websites like Payscale or [removed] They provide salary ranges based on job titles, location, and experience level (entry-level in this case).

Some additional tips for freshers applying to Northwestern Mutual:

- Highlight Relevant Skills and Achievements: Showcase your communication skills, interpersonal skills, and any sales experience in your resume and cover letter. Emphasize transferable skills like problem-solving and relationship building.

- Research Northwestern Mutual: Learn about Northwestern Mutual’s mission, values, and financial products to demonstrate your understanding of the company during your interview. Be prepared to discuss your career goals and why you’re interested in financial services.

- Prepare for Common Interview Questions: Research common interview questions for financial advisor or sales representative roles, especially behavioral ones, and practice your responses to make a strong impression during the interview process.

By showcasing your qualifications, research, and enthusiasm, you can increase your chances of landing a job at Northwestern Mutual!

Top questions Asked for freshers in Northwestern Mutual

Northwestern Mutual is a financial services company specializing in life insurance, disability income insurance, and long-term care insurance. As a fresher interviewing for a role at Northwestern Mutual, expect questions that assess your:

- Sales Aptitude and Communication Skills:

- Describe a situation where you had to persuade someone of your point of view. (Highlight your ability to communicate effectively and navigate objections).

- How do you stay motivated and achieve goals in a sales-oriented environment? (Showcase your drive, resilience, and goal-oriented approach).

- What are your strengths and weaknesses when it comes to sales? (Be honest, but highlight strengths relevant to financial sales, like strong communication, active listening, and the ability to build rapport).

- Financial Services Knowledge (may vary by role):

- Do you have a basic understanding of financial planning and risk management? (It’s okay if you don’t, but eagerness to learn is essential).

- (For specific roles): How would you explain the benefits of life insurance to a young professional? (This might be relevant for financial advisor or sales roles).

- General Skills:

- Tell me about yourself and your interest in Northwestern Mutual. (Highlight your relevant skills (communication, teamwork, problem-solving), academic background, and what interests you about financial services or helping people achieve financial security).

- Describe a time you faced a challenge and how you overcame it. (Focus on problem-solving skills and resilience).

- Why do you want to work at Northwestern Mutual? (Express your interest in helping people, financial security, or a specific aspect of their financial services, and how it aligns with your values).

- Do you have any questions for us? (Always have thoughtful questions prepared about the role, training programs for freshers, and career development opportunities at Northwestern Mutual).

Tips:

- Be aware that some Northwestern Mutual roles might involve working evenings or weekends to meet with clients. Be prepared to discuss your availability.

- Research Northwestern Mutual’s core values and mission statement to see how they align with yours.

How to apply for job in Northwestern Mutual?

Here’s a guide on applying for a job at Northwestern Mutual:

- Visit the Northwestern Mutual Careers Website: Head over to Northwesten Mutual career page.

- Search for Jobs: Utilize keywords related to “financial advisor”, “financial representative”, “sales”, or “client service” and your location. Look for “Entry Level” or “Associate” positions that align with your skills and interests.

- Find the Perfect Fit: Carefully read job descriptions and identify roles that align with your qualifications and aspirations within the financial services industry. Consider your strengths and whether you prefer a client-facing sales role or a more analytical role supporting financial advisors.

- Apply Online: Submit your application electronically for the chosen position. Tailor your resume and cover letter to highlight your communication skills, relevant coursework (if any in business or finance), and your desire to help people achieve financial security.

- Prepare for Interview: If shortlisted, research Northwestern Mutual and the specific role further. Learn more about basic financial concepts like life insurance and financial planning (to the best of your ability). Practice answering common interview questions and prepare thoughtful questions for the interviewer about the role, company culture, and mentorship opportunities for freshers at Northwestern Mutual. Demonstrate your professionalism, strong work ethic, and potential to excel in a dynamic and client-focused environment.

By showcasing your relevant skills, interest in financial services, and willingness to learn, you can increase your chances of landing a job at Northwestern Mutual.

Say goodbye to the hassles of bike ownership! MotoShare.in offers affordable rentals, whether you need a scooter for errands, a bike for a road trip, or a reliable ride to explore new cities.

Starting: 1st of Every Month

Starting: 1st of Every Month  +91 8409492687

+91 8409492687  Contact@DevOpsSchool.com

Contact@DevOpsSchool.com