Principal Financial Group, often shortened to Principal, is a major player in the financial services industry. Here’s a quick look:

- Retirement and Income Solutions: They specialize in retirement planning products and services, including IRAs, 401(k) plans, and annuities, helping individuals secure their financial future.

- Diverse Portfolio: Principal offers a wide range of other financial products as well, including life insurance, disability insurance, and investment solutions.

- Global Reach: With operations in multiple countries, Principal serves a broad client base worldwide.

What are the selection and Interview process of Principal Financial?

The selection process at Principal Financial can vary depending on the specific role, location, and level of experience. Here’s a general breakdown of what you might encounter:

1. Application: Submit your resume and cover letter through Principal Financial’s careers website.

2. Screening and Review: Recruiters will carefully review applications to assess your fit for the role based on the qualifications and experience outlined in the job description.

3. Interview Stages: If shortlisted, prepare for a multi-stage interview process, including:

- Phone Interview: An initial phone conversation with an HR representative or hiring manager to discuss your background, motivations, and interest in the financial services industry, particularly retirement planning and insurance solutions (depending on the role).

- Video Interview(s): Principal may utilize video conferencing platforms for some interview stages.

- In-Person Interview(s): These interviews may involve multiple rounds with hiring managers from relevant departments (e.g., sales, financial planning, customer service, risk management), and potentially senior leadership depending on the role. Here’s what you might encounter based on the role:

- Financial Advisor or Sales Roles: Expect questions about your understanding of financial products (especially retirement and insurance solutions), sales experience, and ability to build relationships with clients.

- Financial Planning Roles: Be prepared for discussions about your knowledge of financial planning principles, ability to create personalized financial plans, and strong analytical skills.

- Customer Service or Account Management Roles: You might encounter questions about your customer service experience, communication skills, and ability to explain complex financial concepts in an understandable way.

- General Interview Questions: Behavioral interview questions using the STAR method (Situation, Task, Action, Result) will be used to assess your relevant skills and experiences across various roles.

4. Additional Assessments: Some positions may involve online assessments to evaluate your financial planning knowledge (for financial advisor roles), basic math skills (for sales or finance roles), or cultural fit.

5. Offer and Background Check: Successful candidates will receive a job offer contingent on a background check.

Tips for Success:

- Research Principal Financial thoroughly, understanding their product portfolio (focus on retirement solutions and insurance), commitment to financial security, and their global reach.

- Tailor your resume and cover letter to highlight relevant skills and experiences that demonstrate a strong fit for the specific role you’re applying to.

- Be prepared for technical assessments or discussions about financial planning concepts or Principal’s specific products (depending on the role).

- Practice your behavioral interview skills using the STAR method.

- Show your passion for helping people achieve financial security, strong communication and interpersonal skills, and an eagerness to contribute to a company that empowers individuals to plan for their future.

By understanding Principal Financial’s selection process and being well-prepared, you can increase your chances of landing a position and becoming part of a team that helps people build a brighter financial future.

How many rounds of interview conducted in Principal Financial?

The exact number of interview rounds for freshers at Principal Financial can vary depending on the specific role, location, and even the year you’re applying [1, 2]. Here’s a general idea gleaned from job postings, employee experiences, and career websites:

Possible Range of Interview Rounds:

- Two to four interview rounds [1, 2].

Here’s a possible breakdown of the interview stages:

- Initial Application: Submit your resume, cover letter, and you might encounter a web-based assessment about your skills or suitability for the role (often for some roles) [2].

- Phone Interview (possible): A recruiter might conduct a brief phone interview to discuss your experience and interest in Principal Financial [1, 2].

- In-Person Interviews (one to three rounds): These could involve discussions with [1, 2]:

- Hiring Manager or Team Members: They will assess your qualifications, experience (if any), and fit for the specific role (e.g., financial analysis skills for some roles, general business acumen).

- Senior Management (possible for some roles): For leadership or higher-level positions, you might meet with senior-level managers to assess your potential for growth within Principal Financial.

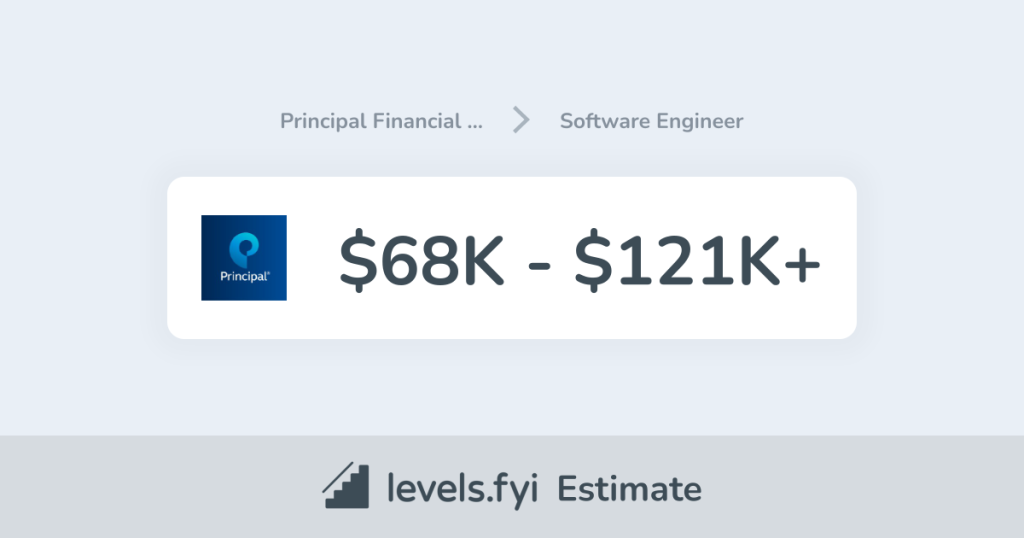

What is the salary for freshers in Principal Financial?

Publicly available information on exact salaries for freshers at Principal Financial isn’t advertised on their careers website [3]. Here are ways to get a better idea of the range for entry-level positions:

- Salary Websites: Explore salary websites like Glassdoor or Indeed. Search for “Principal Financial” and filter by “entry-level” or “freshers” positions in your target location to get a sense of the range for similar roles (e.g., financial analyst, marketing associate).

- Salary Negotiation: Be prepared to discuss salary during the offer stage, especially if you have relevant experience or a strong educational background in finance, business administration, or a related field. Research salary ranges beforehand and highlight your skills and willingness to learn to justify your desired compensation.

Tips for Landing a Job at Principal Financial:

- Research Principal Financial: Learn about their areas of focus in retirement planning, insurance, and asset management [3]. Understand their mission of helping people achieve financial security [3]. This demonstrates your genuine interest during the interview.

- Highlight Relevant Skills and Experience: Tailor your resume to showcase skills and experiences relevant to the specific role you’re applying for. This could include financial analysis skills (for finance roles), communication skills, and a passion for the financial services industry.

- Prepare for Behavioral and Situational Questions: Be prepared to answer questions using the STAR method (Situation, Task, Action, Result) to showcase your problem-solving skills and achievements in previous work experiences.

By following these steps, you’ll gain a better understanding of the interview process and potential salary range for freshers at Principal Financial. Remember, the specific details can vary depending on the role and your qualifications. During the interview process, if there’s an opportunity to ask questions, you can inquire politely about the typical interview structure for the position you’re applying for.

Top questions Asked for freshers in Principal Financial

Principal Financial offers exciting opportunities for recent graduates (freshers) in various departments:

- Finance: Financial analysts, investment analysts (finance or mathematics background preferred)

- Sales & Marketing: Sales associates, marketing associates

- Risk Management: Risk analysts (finance or data analysis background preferred)

- Technology: Software engineers, data analysts, IT support specialists (technical background preferred)

- Human Resources: HR generalist, HR specialist (business or HR background preferred)

Here are some general questions you might encounter during an interview, along with some specific examples depending on the role:

General Skills and Financial Services Industry (Basic Understanding is Okay):

- Tell me about yourself and your interest in Principal Financial. (Highlight relevant skills like communication, teamwork, problem-solving abilities, analytical thinking (if applicable to the role), and an interest in finance, sales & marketing, risk management, technology, or human resources. Mention what interests you about Principal Financial’s focus on retirement planning, insurance products, or a specific service they offer (if applicable)).

- Describe a situation where you demonstrated excellent analytical skills. (Focus on how you analyzed data or a situation to reach a conclusion (applicable to finance, risk management, and data analyst roles)).

- Explain a time you had to work effectively in a team on a project. (Showcase your teamwork abilities and communication skills).

- What are your strengths and weaknesses? (Be honest but highlight strengths relevant to Principal Financial or your desired role, like attention to detail, ability to learn quickly, and a strong work ethic).

- Why do you want to work at Principal Financial? (Express interest in learning about the financial services industry, a desire to gain experience in a Fortune 500 company with a focus on financial security, or an interest in Principal Financial’s specific areas of focus like wealth management or technology solutions (if applicable)).

- Do you have any questions for us? (Always have thoughtful questions about the role, company culture, or mentorship programs for freshers at Principal Financial).

Additional Questions (May Vary by Role):

- (For Finance Roles): Be prepared to discuss basic financial concepts or any relevant coursework in finance or mathematics (if applicable).

- (For Sales & Marketing Roles): Describe a product you are passionate about and why (if applicable to your understanding of marketing).

- (For Risk Management Roles): Be prepared to discuss basic risk management principles or any relevant coursework in finance or data analysis (if applicable).

- (For Technology Roles): Be prepared to discuss basic programming concepts or data analysis techniques (depending on the specific role).

- (For HR Roles): Describe a situation where you demonstrated strong interpersonal skills and conflict resolution abilities (if applicable to your experience).

Tips:

- Show your enthusiasm and willingness to learn, even if your financial services industry knowledge is basic. Principal Financial emphasizes integrity, teamwork, and a strong work ethic.

- Highlight your ability to work independently, follow instructions, and be a team player in a potentially fast-paced and results-oriented environment.

- Demonstrate a problem-solving mindset and an interest in learning about the financial services industry and Principal Financial’s contributions to financial well-being.

How to apply for job in Principal Financial?

Here’s a guide on applying for a job at Principal Financial:

- Visit the Principal Financial Careers Website: Head over to Principal Financial Careers Website page.

- Search for Jobs: Utilize keywords related to your field or browse job categories (“Entry Level” or “Associate” positions are good options). Look for titles that align with your skills and interests (e.g., Financial Analyst, Sales Associate, Risk Analyst, Software Engineer, Data Analyst, IT Support Specialist, HR Generalist, HR Specialist).

- Find the Perfect Fit: Carefully read job descriptions and identify roles that align with your qualifications and aspirations. Consider your strengths and what kind of work environment you prefer (financial analysis, sales floor, office setting, technical development environment, HR department).

- Apply Online: Submit your application electronically for the chosen position. Tailor your resume and cover letter to the specific role, highlighting relevant coursework, any prior experience (if applicable), and your eagerness to learn and contribute to Principal Financial’s mission of helping people achieve financial security.

- Prepare for Interview: If shortlisted, research Principal Financial further, including their focus on retirement and insurance solutions, their commitment to corporate social responsibility, and their global reach. Practice answering common interview questions and prepare thoughtful questions for the interviewer about the role, company culture, and development programs for freshers at Principal Financial. Demonstrate your professionalism, strong work ethic, and potential to excel in this dynamic financial services industry.

Say goodbye to the hassles of bike ownership! MotoShare.in offers affordable rentals, whether you need a scooter for errands, a bike for a road trip, or a reliable ride to explore new cities.

Starting: 1st of Every Month

Starting: 1st of Every Month  +91 8409492687

+91 8409492687  Contact@DevOpsSchool.com

Contact@DevOpsSchool.com