Alright folks, it’s time to dive into the world of cryptocurrency exchanges. If you’re new to the game, you may be wondering what the heck they are and how they work. Don’t worry, we’ve got you covered.

Let’s Start with the Basics

First things first, what is a cryptocurrency exchange? Simply put, it’s a digital marketplace where you can buy, sell, and trade cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

Think of it like a stock exchange, but instead of buying and selling stocks, you’re buying and selling digital currencies.

How Do They Work?

Cryptocurrency exchanges work by connecting buyers and sellers and facilitating the trades. When you want to buy a cryptocurrency, you’ll place an order on the exchange and wait for a seller to accept your offer.

Similarly, if you want to sell a cryptocurrency, you’ll place an order on the exchange and wait for a buyer to accept your offer.

Once the trade is complete, the cryptocurrency will be transferred to your wallet on the exchange.

Types of Cryptocurrency Exchanges

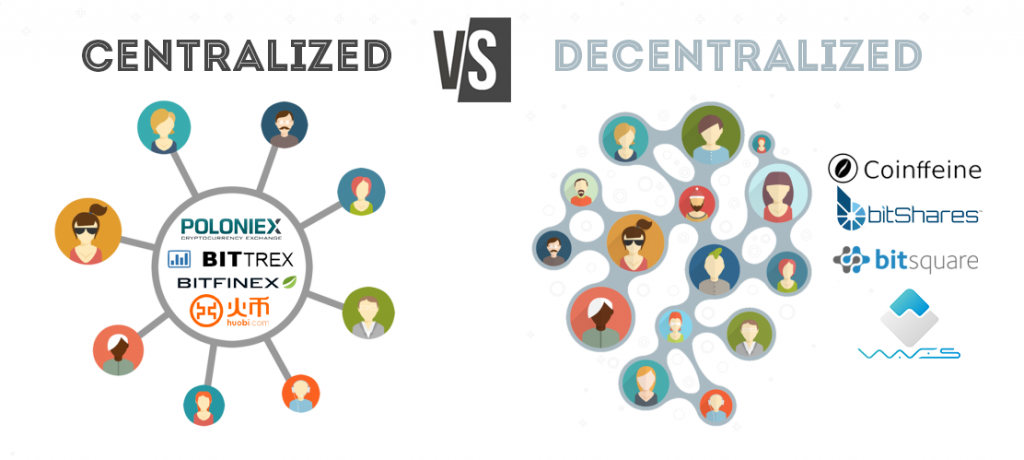

There are a few different types of cryptocurrency exchanges, each with their own advantages and disadvantages.

Centralized Exchanges

Centralized exchanges are the most common type of exchange. They are run by a single entity and all trades go through that entity.

The advantage of centralized exchanges is that they are typically easy to use and offer a wide variety of cryptocurrencies to trade. However, they are also more susceptible to hacking and other security vulnerabilities.

Decentralized Exchanges

Decentralized exchanges, or DEXs, are a newer type of exchange that is gaining popularity. They operate on a blockchain network and allow for peer-to-peer trading without the need for a central authority.

The advantage of DEXs is that they are more secure and less susceptible to hacking. However, they may not offer as many cryptocurrencies to trade and can be more difficult to use.

Tips for Using a Cryptocurrency Exchange

Now that you know what a cryptocurrency exchange is and how they work, here are a few tips for using one:

- Do your research before choosing an exchange. Look for one with a good reputation and strong security measures.

- Set up two-factor authentication to add an extra layer of security to your account.

- Only keep the amount of cryptocurrency on the exchange that you plan to trade. Transfer the rest to a secure offline wallet.

- Keep an eye on the fees. Some exchanges charge high fees for trades and withdrawals.

Wrapping Up

There you have it, folks. A brief overview of cryptocurrency exchanges and how they work. Remember, always do your research and stay safe when trading cryptocurrencies.

Happy trading!

Email- contact@devopsschool.com

Starting: 1st of Every Month

Starting: 1st of Every Month  +91 8409492687

+91 8409492687  Contact@DevOpsSchool.com

Contact@DevOpsSchool.com