New York Life Insurance Company (NYLIC) is a leading insurance provider in the United States. Founded in 1845, it boasts a long history of financial stability and is:

- The third-largest life insurance company in the U.S.

- The largest mutual life insurance company in the U.S. (meaning it’s owned by its policyholders, not shareholders)

- Ranked #71 on the 2023 Fortune 500 list

NYLIC offers a wide range of insurance and financial products, including:

- Life insurance (whole, term, universal)

- Long-term care insurance

- Annuities

- Disability insurance

- Retirement planning services

They are known for their commitment to customer service and their focus on providing long-term financial security for their clients.

What are the selection and Interview process of New York Life Insurance?

Selection and Interview Process at New York Life Insurance

The selection process at New York Life Insurance typically involves several stages, with a focus on evaluating your:

1. Application: Submit your resume and cover letter through their careers website: newyorklife

2. Online Assessments (may apply): You might encounter online assessments to gauge your:

- Skills and qualifications: Matching your skills and knowledge to the specific role requirements.

- Cognitive abilities: Reasoning, problem-solving, and decision-making abilities.

- Personality (may apply): Assessing cultural fit and suitability for the company’s work environment.

3. Interviews: If shortlisted, you can expect:

- Phone/Video Interview: Conducted by a recruiter or hiring manager, focusing on your background, qualifications, and motivations for applying.

- In-Person Interviews: Typically involving 1-2 interviews with team members or hiring managers. These stages delve deeper into your:

- Technical skills (depending on the role, e.g., financial analysis for some positions)

- Experience relevant to the specific role

- Problem-solving abilities

- Communication and interpersonal skills

4. Additional Assessments (for specific roles): Some positions, particularly those requiring leadership or sales skills, might involve an additional assessment stage. This could include:

- Presentations: Showcasing your communication and analytical skills.

- Role-playing exercises: Assessing your ability to interact with clients or navigate sales scenarios.

5. Job Offer: Upon successful completion of these stages, you might receive a formal job offer with details like salary, benefits, and start date.

Here are some additional points to remember:

- The specific process may vary depending on the position, department, and location.

- New York Life emphasizes a candidate experience focused on respect and open communication.

- They value candidates who demonstrate:

- Strong communication and interpersonal skills

- Analytical and problem-solving abilities

- A passion for helping others achieve financial security

- A commitment to ethical and professional conduct

How many rounds of interview conducted in New York Life Insurance?

The number of interview rounds at New York Life Insurance can vary depending on the specific role, location, and business unit you’re applying to. Here’s a general idea:

- Minimum: Typically, there are at least 2 rounds:

- 1. Phone/Video Interview (Initial Screening): This is a preliminary conversation to assess your basic qualifications and interest in the role.

- 2. In-Person Interview (Final Round): This is the most in-depth stage with the hiring manager, team members, or even senior leaders within the company. It might involve behavioral, technical (for some roles), and fit questions.

- Possible Additional Rounds:

- Skills Assessment: Some positions might involve online assessments for basic skills or job-specific abilities.

- Multiple In-Person Interviews: For senior roles or those requiring in-depth expertise, there could be additional rounds with different teams or decision-makers.

Tips to Find Out the Exact Number:

- New York Life Careers Website: While it might not explicitly list interview rounds, the job description or the application process might mention online assessments.

- Contact the Recruiter: During the application process or the initial interview, you can inquire about the typical interview process for the specific role you’re interested in.

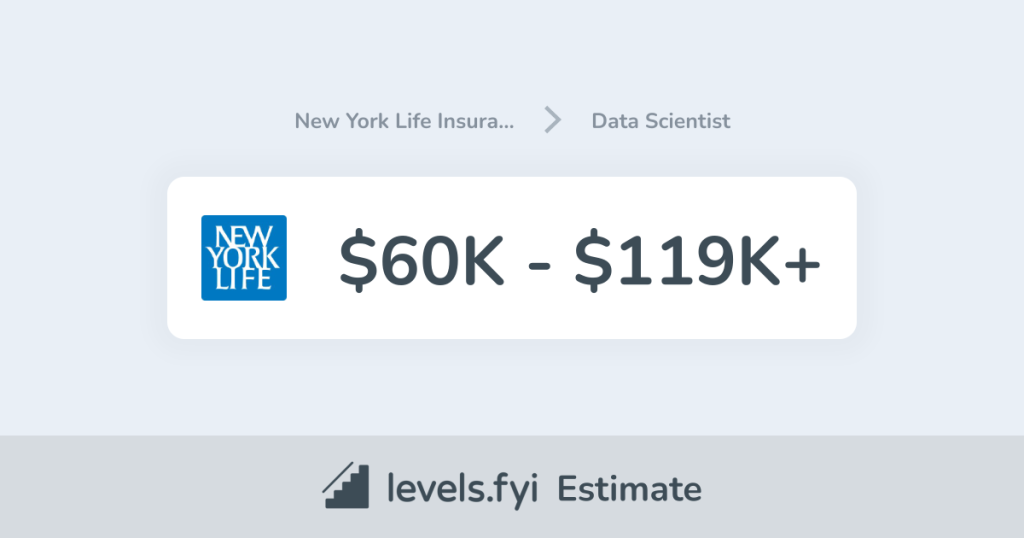

What is the salary for freshers in New York Life Insurance?

Determining the exact salary for freshers at New York Life Insurance is challenging due to several factors:

- Varying Roles and Locations: Salaries can differ significantly based on the specific role (e.g., sales agent, financial services representative, IT analyst) and location (cost of living varies).

- Limited Public Data: Salary information for entry-level positions can be limited, especially for specific roles or locations.

General Salary Range (Freshers in US):

Based on sources like Glassdoor and Payscale, here’s a general range for entry-level salaries at New York Life Insurance in the United States:

$45,000 – $60,000 per annum: This range is based on data points from various sources and can serve as a starting point. The actual salary could fall outside this range depending on the factors mentioned above.

Best Way to Get Accurate Salary Information:

- Contact the Recruiter: During the application process or the interview, you can inquire about the salary range for the specific role and location you’re applying for. This is the most reliable way to get the most up-to-date information.

Salary is just one factor to consider when evaluating a job offer. Other factors like benefits, commission structure (for sales roles), career growth opportunities, and work-life balance are also important aspects to consider in your decision-making process.

Top questions Asked for freshers in New York Life Insurance

New York Life Insurance seeks passionate individuals who can contribute to their mission of providing long-term financial security. Here are some common interview questions for freshers:

General Experience & Skills:

- Tell me about yourself and your interest in this role. (Focus on relevant skills and passion for the insurance industry or financial services.)

- Describe a time you faced a challenge and how you overcame it. (Highlights problem-solving, adaptability, and resilience.)

- What are your greatest strengths and weaknesses? (Demonstrate self-awareness and a growth mindset.)

- Tell us about a time you had to work effectively in a team. (Showcase teamwork, communication, and collaboration skills.)

New York Life Insurance Specific:

- Why do you want to work at New York Life Insurance? (Research the company, its mission, and how it aligns with your interests.)

- What do you know about New York Life Insurance products and services? (Basic knowledge demonstrates interest.)

- How do you see yourself contributing to New York Life Insurance’s mission? (Connect your skills and values with the company’s goals.)

- Are you comfortable with cold calling (for sales roles)? (Express willingness to learn and develop communication skills.)

Additional Questions (depending on the role):

- Basic financial or insurance concepts: Be prepared for foundational questions related to finance, risk management, or basic insurance products if relevant to the role.

- Technical Skills: Some positions might involve questions about data analysis, technology skills, or software proficiency.

Behavioral and Situational Questions (using STAR method – Situation, Task, Action, Result):

- Describe a time you had to learn a new concept or skill quickly. How did you approach it? (Shows learning agility and adaptability)

- Tell us about a time you had to manage your time effectively to complete multiple tasks. (Demonstrates time management and prioritization skills)

- How do you handle working in a fast-paced environment? (Assesses your ability to manage pressure and meet deadlines)

How to apply for job in New York Life Insurance?

Here’s a step-by-step guide to applying for jobs at New York Life Insurance:

1. Visit the Careers Website:

- Go to the official New York Life Insurance careers website: newyorklife

2. Search for Open Positions:

- Utilize the search bar to find jobs that match your skills and experience. You can filter by keyword, location, department, and job category. Consider searching for terms like “entry-level,” “recent graduate,” or “associate” to find opportunities suitable for freshers.

3. Review Job Descriptions Carefully:

- Once you identify a relevant position, thoroughly read the job description.

- Ensure your qualifications and experience align with the requirements listed (skills, educational background, years of experience).

- Tailor your resume and cover letter to highlight skills mentioned in the job description.

4. Prepare Your Application Materials:

- Resume: Tailor your resume to highlight relevant skills and achievements for the specific position. Use keywords from the job description and focus on results using the STAR method.

- Cover Letter (optional, but recommended): Craft a personalized cover letter expressing your interest in the role and company. Explain why you’re a good fit and how your skills and values align with New York Life Insurance’s mission. Highlight what excites you about the insurance industry.

- Additional Documents: Check if the application requires transcripts, references, or project reports related to your academic work.

5. Submit Your Application Online:

- Follow the application instructions on the job posting.

- Upload your resume, cover letter (if applicable), and any other required documents through the online portal.

- Answer any additional questions on the application form related to your availability, skills assessments, or salary expectations.

Tips:

- Set Up Job Alerts: Sign up for job alerts on the New York Life Insurance careers website to receive notifications about new openings.

- Research the Company: Visit the company website, read news articles, and explore their social media to understand their work culture and values.

- Connect with New York Life Insurance on Social Media: Follow them on LinkedIn and Facebook to learn about company culture and job opportunities.

- Practice for Interviews: Research common interview questions and practice your answers using the STAR method.

👤 About the Author

Rahul is passionate about DevOps, DevSecOps, SRE, MLOps, and AiOps. Driven by a love for innovation and continuous improvement, Rahul enjoys helping engineers and organizations embrace automation, reliability, and intelligent IT operations. Connect with Rahul and stay up-to-date with the latest in tech!

🌐 Connect with Rahul

-

Website: MotoShare.in

-

Facebook: facebook.com/DevOpsSchool

-

X (Twitter): x.com/DevOpsSchools

-

LinkedIn: linkedin.com/company/devopsschool

-

YouTube: youtube.com/@TheDevOpsSchool

-

Instagram: instagram.com/devopsschool

-

Quora: devopsschool.quora.com

-

Email: contact@devopsschool.com